MyProNoblis

Invest

Open Business Forum

Aktuelle Informationen zum Corona-Virus

The name "ProNoblis" is based on the Latin language. Loosely translated, it means "We for us" - and thus describes the core of our philosophy. Because ProNoblis is help for self-help: by us, for us. Since 2003, we have been working successfully to bring companies and investors together and to create alternatives to bank offers - we see ourselves as an SME financier for SMEs (small and medium-sized enterprises). This is precisely what we have been doing since August 2018 in ProNoblis AG, which was created by transforming a predecessor company that had existed since 2013.

We equip SMEs with working capital. We benefit from decades of experience and have built an excellent network.

Our Solution

Goods purchasing financing

loan

subordinated loan

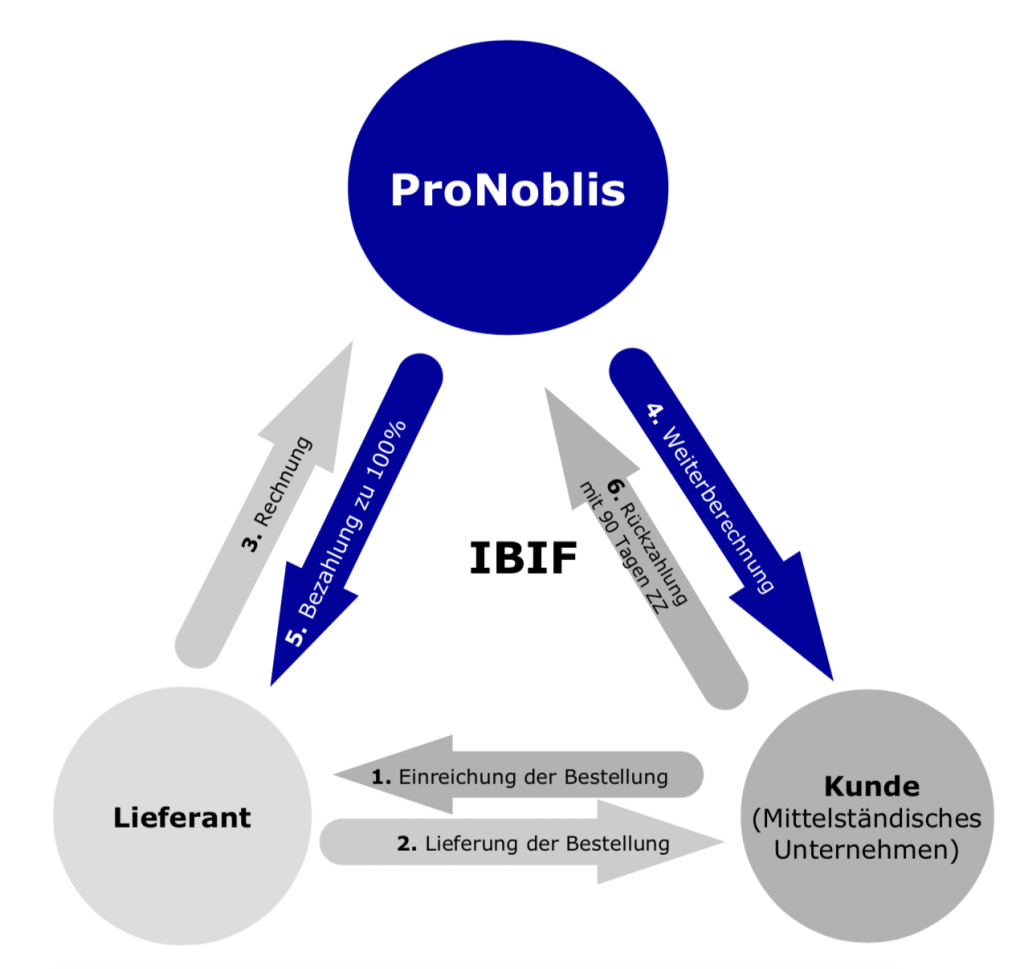

The tried-and-tested IBIF process

Working Capital / IBIF: InBetweenerInvoiceFinance: The planned, calculated advance/interim financing of goods orders with payment terms of up to 90 days. Our trade credit insurance serves as collateral.

IBIF - ProNoblis' solution for Working Capital

Reasons for your cooperation with ProNoblis

Expertise & Consulting

Our experts are ready to help you with your questions.

Partner of the Mittelstand

We offer fast and easy solutions for Corporate Financing since 2013

Global network

ProNoblis is successful with it's network. Our partners are global and support you with your international activities.

ProNoblis AG

Who are we?

Success requires the right partners – because right partners make a significant contribution to the success of a company.

ProNoblis AG is your partner for the procurement of industrial goods.

We negotiate prices and discounts for you with suppliers and give you the financial leeway you need to fulfill your short-term orders.

We have been an established partner to German SMEs since 2013 and have been repositioned as a public limited company since 2018. Our core product is the full-service goods purchasing solution IBIF - InBetweener-Invoice-Finance called Working Capital.

Experienced Management

Stefan Schmidt

CEO

Stefan Schmidt worked for many years for various banking groups in the corporate customer business and was last responsible for the Business & Corporate Banking division of a major international bank in the North-Eastern region of Germany. He has also been an entrepreneur since 2003 and has managed several national and international companies with success.

Ulrich Rump

CHAIRMAN OF THE SUPERVISORY BOARD

Ulrich Rump is a lawyer with his own law office in Berlin. He has expertise and many years of experience in various specialist disciplines, such as claims management.

In addition, he has been active as an entrepreneur for many years and has successfully been involved in several companies.

Prof. Dr. Georg Donat

MEMBER OF THE BOARD

Prof. Dr. Georg Donat was a authorized representative at a major international bank in Leipzig.

He is a member of several supervisory boards. As a board member (president) he manages the Marketing Club Leipzig, which has developed into a meeting place for executives from business, science, culture and administration.

Susan Kessler

MEMBER OF THE BOARD

Susan Kessler bringt 20 Jahre Erfahrung als Vorstand der IMW Interessenvereinigung Mittelständische Wirtschaft e.V. mit. In dieser Position hat sie sich besonders auf präventive Lösungen für betriebswirtschaftliche Herausforderungen von KMU sowie auf den Dialog zwischen Politik und Wirtschaft fokussiert. Zudem ist Frau Kessler eine Allfinanzexpertin

und war jahrelang als Produktmanagerin für den Asset Management Bereich einer namhaften banknahen Vertriebsorganisation verantwortlich.

Unsere Prokuristen

Our Mission

The consequences of the financial crisis, stronger regulations (Basel IV) and the withdrawal of banks from this segment are making it increasingly difficult for companies to finance their growth, trade and investments. Small and medium-sized enterprises (SMEs) in particular have problems adapting to the completely different capital market situation. Unlike in earlier upswings, they are no longer able to rely on traditional bank loans in the usual extent. Based on this, financing needs of companies are rising continuously. Especially for SMEs which, due to their size, have no or only very limited access to alternative financing possibilities via public capital markets.

ProNoblis offers innovative financing instruments to SME as a supplement or/and alternative to working capital loans and overdraft facilities. With more working capital, companies can secure their liquidity flow and finance the purchase of goods and projects and in a structurated and targeted manner.

We are thus closing the structural gap in the supply of credit for small and medium-sized enterprises, which has opened up more and more since the financial crisis. We give SMEs access to a highly attractive financing alternative (goods purchase financing), which is decided much more quickly and is less complicated than factoring, supplier credit or financing via bank loans.

Our sales hubs

Local, connected: Simply there for you!

ProNoblis is different, in many ways.

We offer SMEs smart working capital financing - IBIF InBetweenerInvoiceFinance, which is only provided by us.

We combine traditional, well-functioning relationship sales with the advantages of the digital world: speed, availability and cost optimisation. Customers receive comprehensive service, personalised advice and unrivalled processing speed from us. This is how we guarantee lasting customer relationships!

The ProNoblis contact persons are personally available for you on the D-A-CH market.

We are expanding our locations!

Collaterals

No financing without collateral is the only way to protect shareholders and investors. In contrast to traditional house banks, online financial service providers often do not require collateral from customers. Experience has shown that this is a very high risk that cannot be managed with modern technology. That is why SMEs do not receive unsecured financing from us. We hedge our business against any risks: For example, goods purchase financing is only provided up to the authorised trade credit insurance limit per company. Translated with www.DeepL.com/Translator (free version)

Data Protection & Privacy

We do not need access to our customers' accounts. We want to protect the right to privacy - especially in the digital age!

Our Vision

We create customised financing solutions for business customers - fair and transparent. We are the first company with the goal of revolutionising the entire financial world - for a fair and meaningful interaction of our economy and our society and for the prosperity of investors. Working with ProNoblis means: you experience real added value that you deserve.

We all do better when we do better together.

ProNoblis - We for us.

Are you also interested in working with us? As an entrepreneur, supplier or network partner? Get in touch with us! We will be happy to make time for an on-site meeting to work out the best solutions for you.

Book an appointment

for a personal consultation.

Call us

030 790 16 58 80

Contact us

We look forward to receiving your message.

Become part of our network.